IRS tax lawyers can help you navigate the troubles of tax fraud!!

As cliché as it sounds, everybody that goes through the experience of identity theft always responds in the same fashion: “I didn’t think it could happen to me!” Here’s the fact of the matter; every two seconds another identify fraud victim is made in the US. The number of identity fraud victims has jumped to over 13 million in the past year. Knowing both what to do if an attack should occur and how to avoid a potential attack are important. The IRS has provided a list of what you should do if you happen to fall into the unfortunate situation of being a victim of tax fraud.

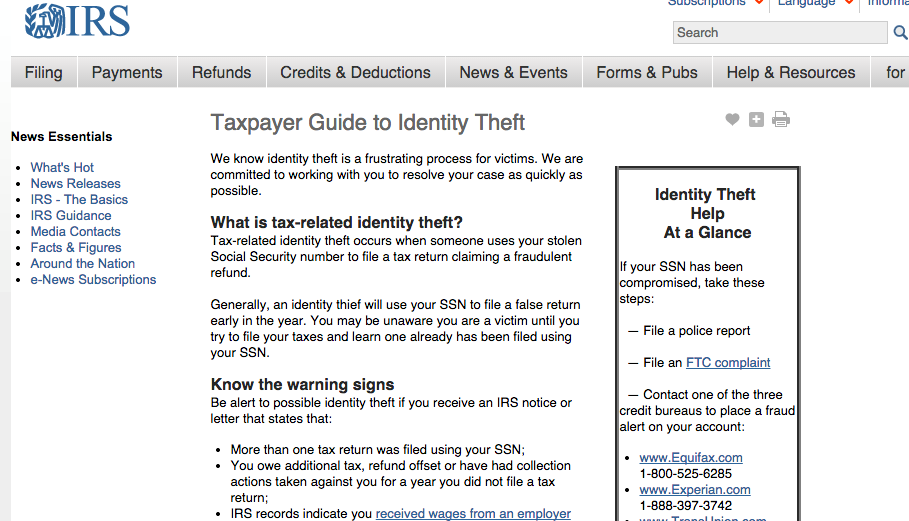

The first thing you’ll want to do is file a report with your local law enforcement agency. As soon as you get the law enforcement agency involved the next step is to contact one of the three major credit bureaus to place a “fraud alert” on your credit records. Experian, Equifax or TransUnion are the best outlets to report any issues to. Contacting your personal financial institutions to close and freeze accounts once you confirm a breach has happened will serve you well in the long run and minimize damage to various accounts.

There are many ways to help minimize the risk of suffering an attack. Keeping your Social Security Card or any other documents that display you SSN in a safe place. Never giving out your SSN to a business, just because they ask for it, will also keep you protected. If they do ask, never feel like you can’t question them as to why they need it. Sometimes it is necessary, so only do it when the situation absolutely calls for it. Also making sure you don’t give out any information over the phone or internet unless you’ve initiated the contact, will help decrease the chances of experiencing a security breach in your personal finances.

Whenever dealing with an identity fraud situation it’s important to reach out to a professional IRS tax lawyer to help you navigate the situation. Whether you’re dealing with fraud or an IRS tax lien, finding reputable tax lawyers like Tax Tiger will help you save stress, time and money.

Source: Tax Payer Guide to Identity Theft – IRS.gov

Latest posts by admin (see all)

- Stock Transactions Can Complicate Taxes If Not Properly Reported - March 2, 2018

- Here are a few helpful summer tips from a trusted San Diego tax lawyer - August 19, 2015

- Involved in Tax Fraud? Get in touch with a Sacramento tax attorney! - August 17, 2015